YOUR NOVEMBER 2023 MARKET REPORT

- Diana Boyd

- Nov 15, 2023

- 2 min read

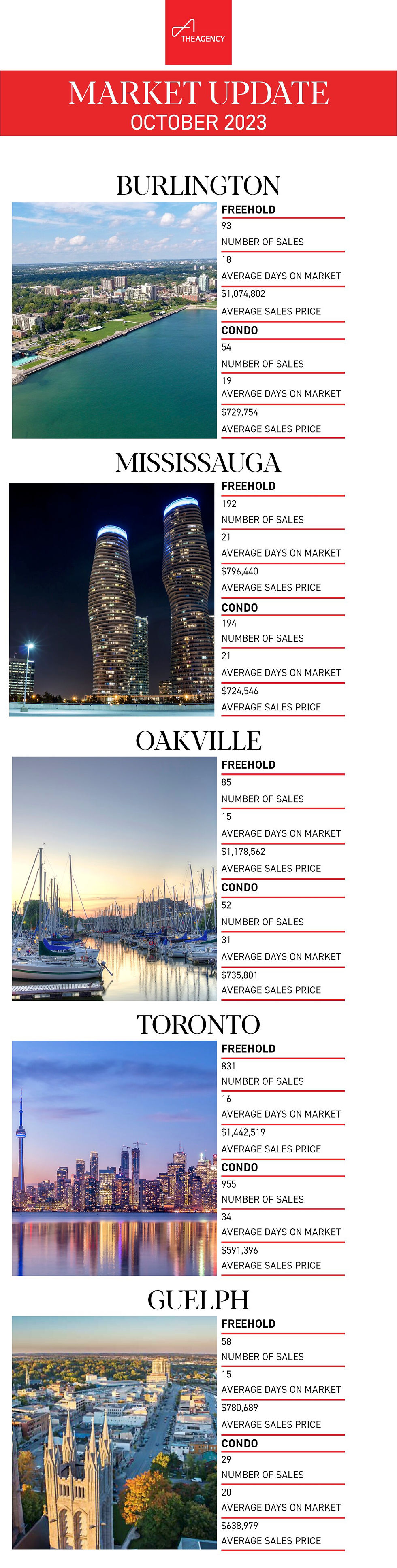

In October 2023, the Greater Toronto Area (GTA) faced persistent challenges of affordability and uncertainty for prospective home buyers. Consequently, home sales experienced a decline compared to the previous year, although selling prices maintained an upward trajectory.

TRREB President Paul Baron attributed the ongoing demand for housing to record population growth and the resilience of the GTA economy. However, he noted a shift in demand towards the rental market due to the impact of high borrowing costs and uncertainty about interest rate trends. Baron expressed optimism, anticipating a swift increase in home sales once mortgage rates start decreasing.

According to reports from REALTORS®, GTA home sales totaled 4,646 through TRREB's MLS® System in October 2023, reflecting a 5.8% decrease from the same period in 2022. On a month-over-month seasonally-adjusted basis, sales also exhibited a decline compared to September.

While new listings in October 2023 showed a noticeable increase from the 12-year low reported in October 2022, the rise was more moderate compared to the 10-year average for October. On a seasonally-adjusted basis, new listings slightly decreased month-over-month in comparison to September 2023.

The October 2023 MLS® Home Price Index Composite benchmark and average selling prices demonstrated year-over-year growth, registering increases of 1.4% and 3.5%, respectively. However, on a seasonally adjusted basis, the MLS® HPI Composite benchmark slightly decreased compared to September 2023, while the average selling price remained stable. Both benchmarks remained above the cyclical lows experienced at the beginning of 2023.

Despite high borrowing costs, the competition among buyers remained robust enough to uphold the average selling price above the levels of the previous year in October and above the cyclical lows seen in the first quarter of the year. TRREB Chief Market Analyst Jason Mercer highlighted the Bank of Canada's acknowledgment of this resilience in its October statement. However, Mercer noted that home prices were still below the record peak reached in early 2022, mitigating the impact of increased borrowing costs to a certain extent.

Expressing disappointment in the current environment of elevated borrowing costs, TRREB CEO John DiMichele highlighted the lack of relief for uninsured mortgage holders reaching the end of their terms. DiMichele criticized the requirement for these borrowers to qualify at rates nearing eight percent when seeking competitive rates, suggesting that the Office of the Superintendent of Financial Institutions should have eliminated this qualification rule for those renewing mortgages with different institutions after their recent consultations.

As always if you have any questions about a particular neighbourhood, please reach out to us at HELLO@BuyingOakville.com.